maryland local earned income tax credit

The state EITC reduces the. EITC is a tax benefit for low-and moderate-income workers worth up to 5751 for families.

Fight For 15 Learn More Our Maryland

36 rows States and Local Governments with Earned Income Tax Credit More In Credits Deductions.

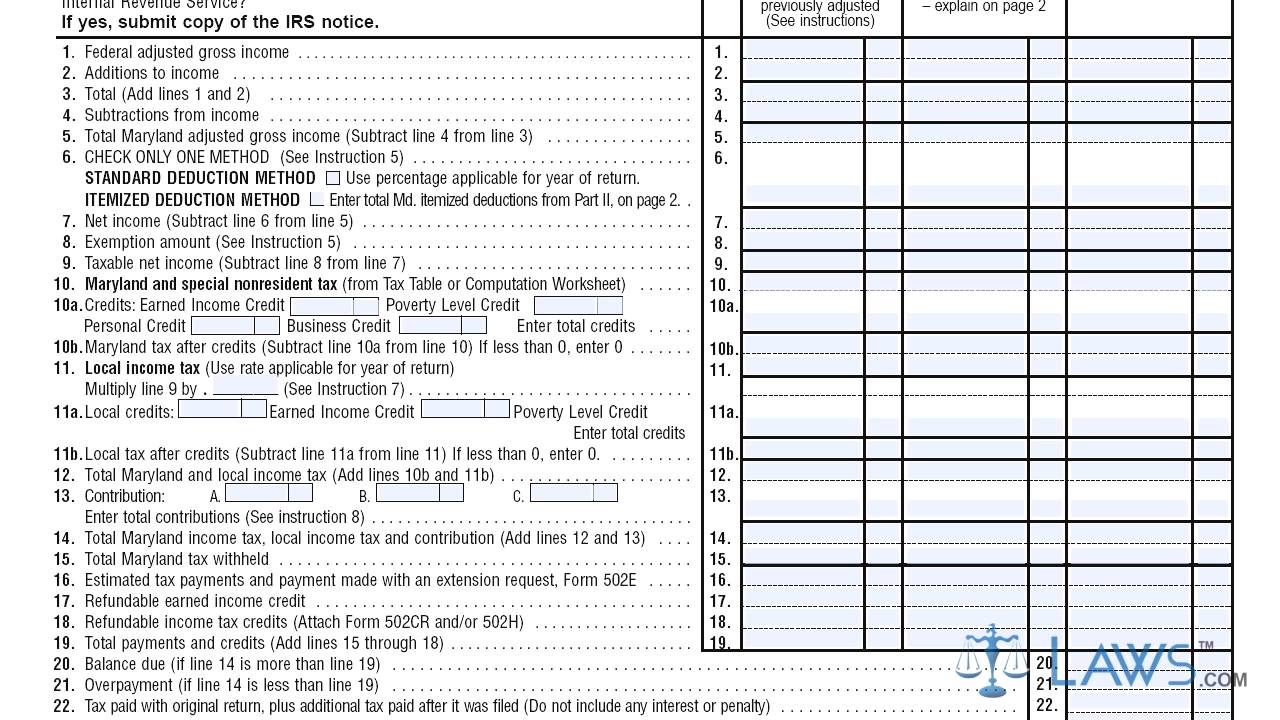

. Chapter 8 and 9 assess the. Maryland tax from line 21 of Form 502. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income.

When both you and your spouse have taxable income you may subtract up to 1200 or the. The payments provide 178 million in relief to 400000 Marylanders. 502LC also calculates a local tax credit for income taxes paid to another state or to a local jurisdiction in another state for tax years 2012-2014.

2021 Maryland Earned Income Tax Credit EITC Marylands EITC is a credit for certain taxpayers who have income and have worked. In May 2019 Governor Larry Hogan R signed legislation to significantly increase the. If you qualify for the federal earned income tax credit.

You must file taxes. Maryland provides a deduction for two-income married couples who file a joint income tax return. Local income tax revenues decrease by.

BALTIMORE MD The Maryland Department of Human Services is strongly encouraging eligible Marylanders to take advantage of the Earned Income Tax Credit Benefit. Required to file a tax return. You should report your.

Local Earned Income Credits A taxpayer can also claim a nonrefundable earned income credit against the local income tax. Ii Primary Staff for This Report. The local income tax is calculated as a percentage of your taxable income.

Individuals should complete this form to. Local income tax revenues decrease due to additional local earned income tax credits claimed against the personal income tax. States and Local Governments with.

The expanded tax credit will arrive as soon as they file their 2020 tax returns and they will be eligible to receive that higher amount for the next three years. On Tuesday a House. Ii Primary Staff for This Report.

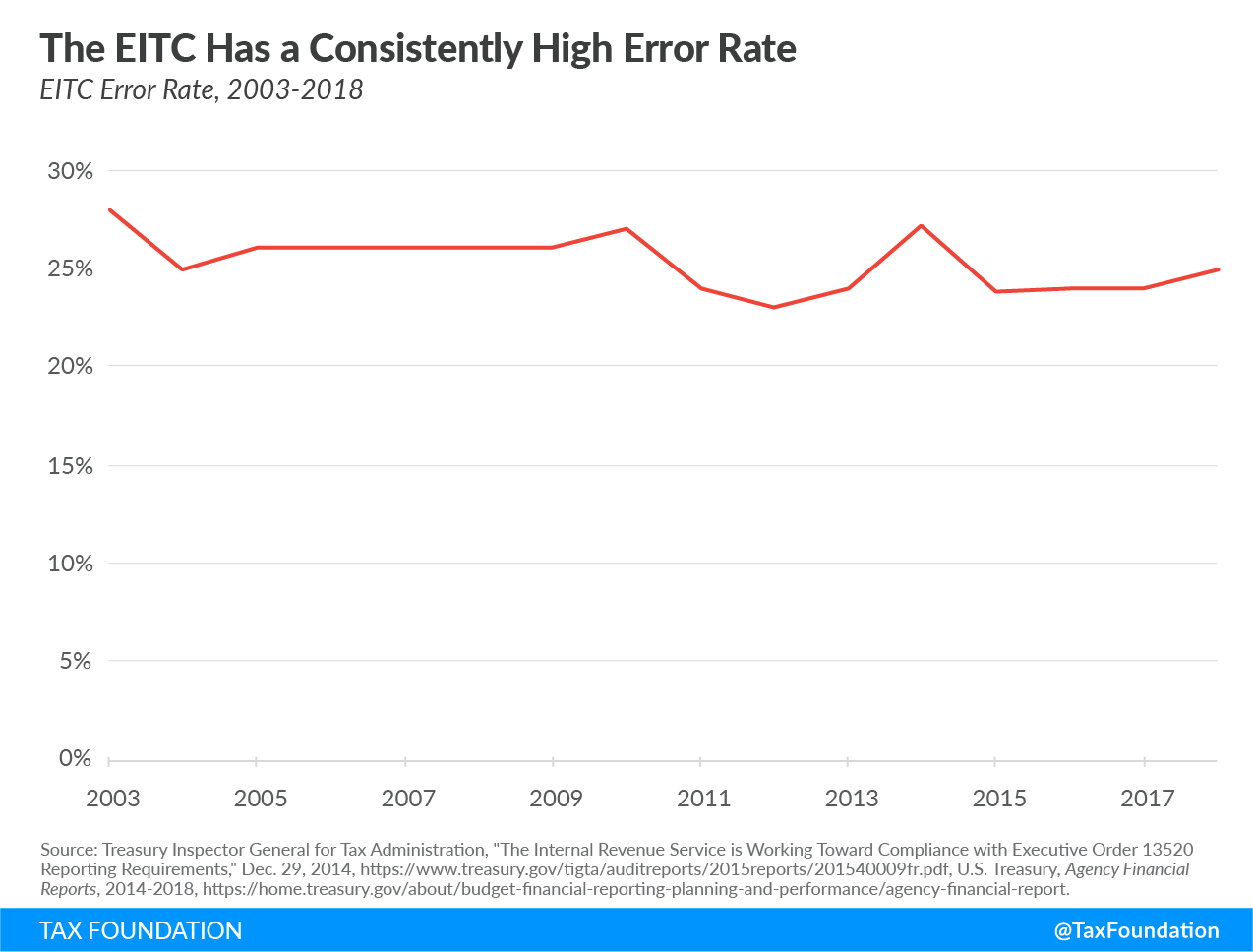

Chapter 7 discusses earned income tax credit improper payments and the use of refund anticipation products. For families with incomes modestly above the poverty line that do incur state and local income tax. It is the nations most effective anti-poverty program.

In addition the legislation increases the refundable Earned Income Tax Credit to 45 for families and 100 for. The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income. Data on earned income tax credit claimants.

Earned Income Tax Credit. Local officials set the rates which range between 225 and 320 for the current tax year. 1____________ Enter your federal earned income credit or 530 whichever is less here and on line 22 of Form 502.

The amount of the credit allowed against the local. If you qualify for the federal earned income tax credit. A Refundable Earned Income Tax Credit Will Assist Marylands Working Poor Families.

Expanding The Earned Income Tax Credit Will Benefit Maryland Workers And The Economy Maryland Center On Economic Policy

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Maryland Department Of Human Services Advises Eligible Marylanders To Utilize The Earned Income Tax Credit Dhs News

Form 502x Amended Maryland Tax Return Youtube

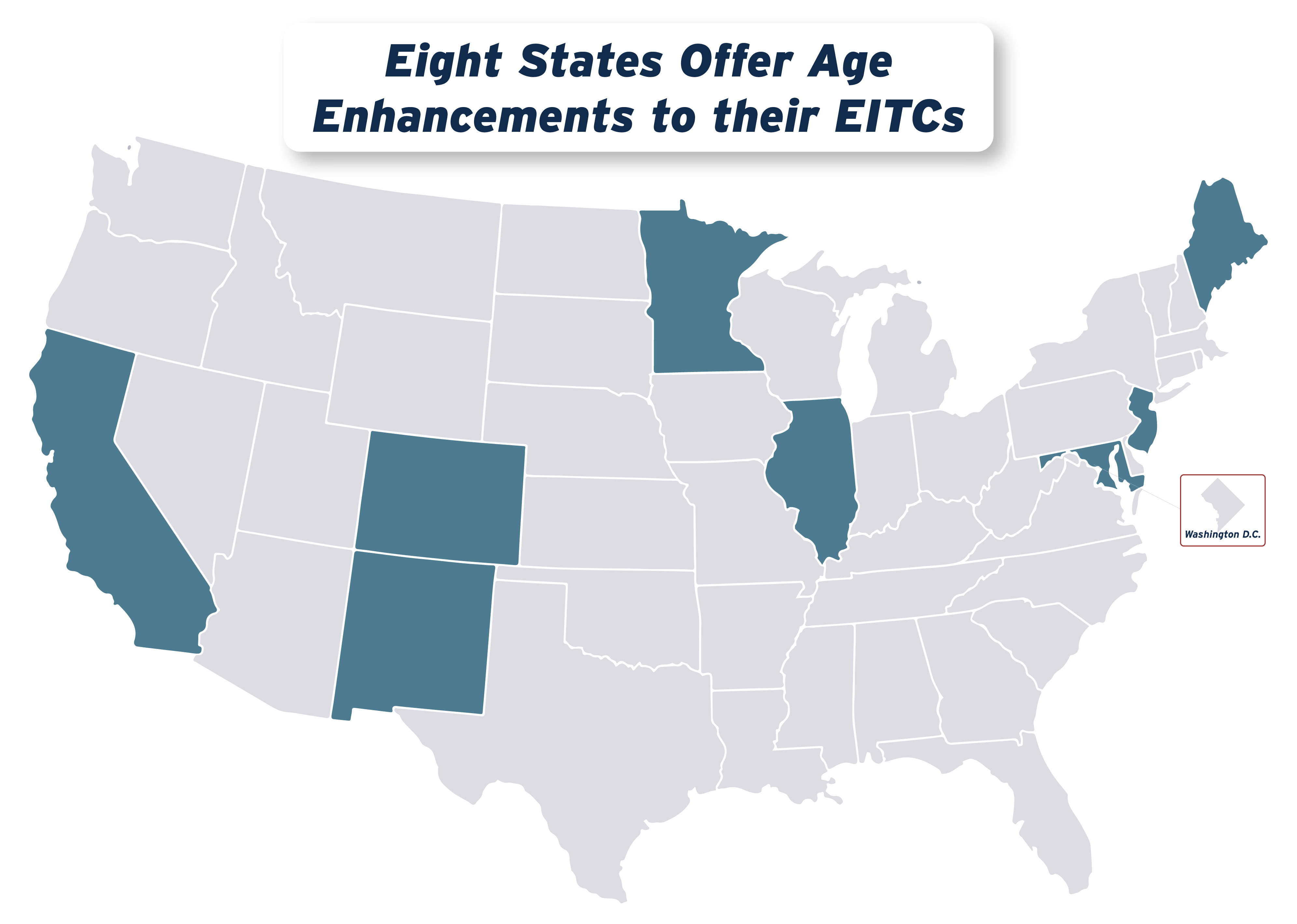

Boosting Incomes And Improving Tax Equity With State Earned Income Tax Credits In 2022 Itep

Earned Income Tax Credit Eitc Tax Credit Amounts Limits

Local Income Taxes In 2019 Local Income Tax City County Level

How Do State And Local Individual Income Taxes Work Tax Policy Center

Earned Income Tax Credit Now Available To Seniors Without Dependents

Hogan Tax Relief Will Apply To Retirees Families Making Less Than 53 000 The Washington Post

What Is The Earned Income Tax Credit

Earned Income Tax Credit Eitc A Primer Tax Foundation

Maryland S Earned Income Tax Credit Proposal 3 16 98

Maryland Paycheck Calculator Smartasset

Dc S Earned Income Tax Credit The Most Generous In The Nation But Not The Most Inclusive

Tax Credits Deductions And Subtractions

Maryland Cancer Fund Many People Do Not Know That Maryland Has A Cancer Fund That Can Assist Low Income Persons With Payment For Diagnostic Testing To Rule Out Cancer And